Tax Reform

Tired of hearing about taxes? This is one of the mega topics guaranteed to grab your attention every time. Why? Because it affects nearly everyone and yet few people understand how taxes get calculated or what those taxes pay. But first, this article is not meant to be "us against them," it is about awareness on an important topic. It is intended to help you understand why taxation is so complicated and what you can do to make it fairer.

It is easy to say that taxes are complicated and a little more difficult to explain why. To help us understand we need some history and a few facts. One website I like to use for a better understanding of taxation is thebradfordtaxinstitute.com where they have this to say about the history of taxes -

The tax law, like almost all laws, grows as lawmakers use it for pork, try to make it fairer, use it to stimulate a sector of the economy, or just want to raise revenue. As Will Rogers said: “The difference between death and taxes is death doesn't get worse every time Congress meets.”

In 1913, the top tax bracket was 7 percent on all income over $500,000 ($11 million in today’s dollars); and the lowest tax bracket was 1 percent.

In 1944, the top rate peaked at 94 percent on taxable income over $200,000 ($2.5 million in today’s dollars). Over the next three decades, the top federal income tax rate remained high, never dipping below 70 percent.

The Economic Recovery Tax Act of 1981 slashed the highest rate from 70 to 50 percent, and indexed the brackets for inflation. Then, the Tax Reform Act of 1986, claiming that it was a two-tiered flat tax, expanded the tax base and dropped the top rate to 28 percent for tax years beginning in 1988. The hype here was that the broader base contained fewer deductions, but brought in the same revenue. Further, lawmakers claimed that they would never have to raise the 28 percent top rate. The 28 percent top rate promise lasted three years before it was broken.

During the 1990s, the top rate jumped to 39.6 percent. However, the Economic Growth and Tax Relief and Reconciliation Act of 2001 dropped the highest income tax rate to 35 percent from 2003 to 2010. The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 maintained the 35 percent tax rate through 2012.

The American Taxpayer Relief Act of 2012 increased the highest income tax rate to 39.6 percent. The Patient Protection and Affordable Care Act added an additional 3.8 percent on to this making the maximum federal income tax rate 43.4 percent.

From this history, you can see that tax laws change regularly. Ok, but why? The simple answer is in the first sentence of the Bradford Tax Institute quote "The tax law, like almost all laws, grows as lawmakers use it for pork, try to make it fairer, use it to stimulate a sector of the economy, or just want to raise revenue." The more honest answer is that we have not created a fair and straightforward tax law. But we can. Let's continue to explore.

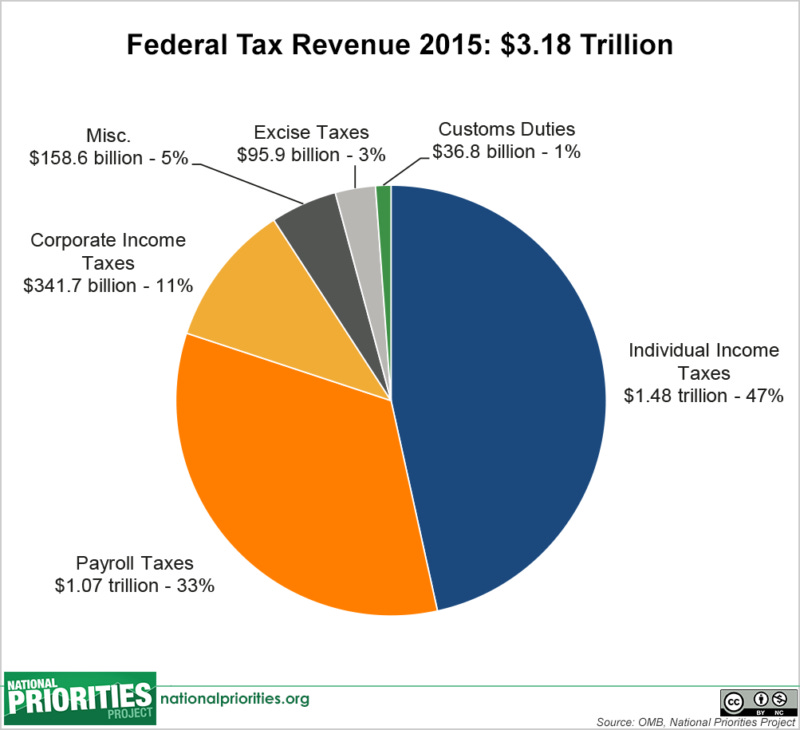

How much tax gets collected and how is it used? I used the website nationalpriorities.org to get this information and below you will see their charts for the 2015 data.

Who pays US tax?

How is the tax that gets collected spent?

Let's digest this information in its simplest terms - in 2015 the US collected $3.18 Trillion and spent $3.8 Trillion. The first thing you see is a deficit of $.62T (don't let my shorthand fool you, that is 620 Billion Dollars). The next thing you notice is that the tax got collected from a number of sources. To find a fair corporate and individual income tax rate we need to exclude payroll, customs, excise, and miscellaneous taxes and focus on the amount of corporate and individual income tax that was collected, that number equals $1.8217T. All we need now is one additional piece of information, how much money do individuals and corporations earn annually?

Based on 2015 information from the US Department of Commerce, total personal income was $15.553 Trillion and corporate profits were $2.118 Trillion, that is a total of $17.671 Trillion. You can confirm this information on the Department of Commerce website or in this PDF. If you take this total income and divide it into the tax that was collected in 2015, you will get the percentage or tax rate required to collect that amount of tax - $1.821T / $17.671T = 10.3%. Wait a minute, am I saying that if all the income from individuals and corporations were taxed at a flat tax rate of 10.3%, we would have collected the same amount of tax in 2015? Yes, that is precisely what I am saying.

It is evident that a simple and effective flat tax could work, and that nobody needs to pay more than 10-15% in income tax. So, what is going on here? In a word, loopholes. Tax breaks.

The most important key to understanding why the tax code is complicated is to know this one fact - tax liability gets calculated on taxable income, not total income. This creates an obscure pathway to adjust the effective tax.

What do I mean when I say an obscure pathway to adjust the effective tax? Because there are thousands of pages in the tax code, only the people that read all of those pages know what the loopholes are. That means the effective tax is not transparent. Nobody knows what tax a person making $100,000 will have to pay. Nobody knows what tax a person making $10,000,000 will have to pay. By making the tax laws an impossible maze, politicians have created a method for unfair taxation. A place to hide special tax breaks that nobody knows about, except the people who want them. This is patently unfair.

It is not the tax rates that make taxation unfair. It is the tax breaks and loopholes that make taxation unfair.

What are the loopholes and tax breaks? Most people are familiar with mortgage interest deductions, the ability to deduct the interest paid on a primary home mortgage and reduce taxable income. But far fewer people know or understand all the other tax breaks written into the tax code. The critical thing to understand is that they are there, and people use them, a lot. How much? As much tax is lost to these loopholes and tax break as the federal government spends on its discretionary spending budget, which is almost one-third of the total budget (see chart below).

Why is this important? Because the only way to make the tax code fair and straightforward is to eliminate all of the loopholes and tax breaks. Every one of them is a special interest item geared to a particular group of people, thereby causing other people to pay more.

Why don't our leaders eliminate these tax breaks? Because you probably do not want to give up your mortgage interest deduction, do you? Of course not, and nobody else wants to give up their tax breaks either. They are worth fighting for, even if that means spending money, or finding others with similar interests and hiring lobbyists and lawyers. And there it is. The reason the tax code is complicated and unfair is due to special interests.

The thing about our country is that we the people have the power to change things, and that is good. The problem is that we the people do not spend time understanding essential topics until they become dire. We rely too much on our politicians to do the right thing and on the press to notify us when they don't. For some things they do an outstanding job, but for other things not so much. Why is that?

First of all, it is our responsibility, not anyone else's. Hard as it may be to drop our daily tasks and spend time making sure our country is run the way we want it to be, that is what we must do. There are powerful special interest groups with lots of money controlling the tax laws, but we the people have a power greater than money. We hold the votes. We must get better at using them.

The press could do a much better job of educating the public about tax laws, and how the media covers topics like tax reform is important to consider. Every publication company needs revenue. Some get their money from selling advertisements and others from donations. Whether a publication company sells advertising or receives donations, the total amount of revenue they receive gets determined by the total number of listeners and viewers they have. Every single company that publishes news must have listeners and viewers, and the more listeners and viewers they have, the more revenue they receive. What would you do if you had a group of one million potential listeners and viewers that wanted a particular type of story? What would you say to a donor or advertiser that gives your company 100 million dollars per year?

I am not proposing that any publication company presents false information, but I am suggesting that it is in the best interest of a publishing company to give its listeners and viewers what they want. Sadly, this is why traffic accidents and other tragedies make the front pages of many local and national publications. That is what the listeners and viewers want. And this is how large donors and advertisers influence the news.

Regarding taxes, most viewers and listeners just want a bad guy, they want to blame someone else. They do not want to spend a whole bunch of time understanding the in and outs of tax laws. They want to be soothed and hear simple reasons the problem never goes away. It is easy to blame people with too much money, and it is a more exciting story.

These same arguments hold true for our politicians. They need a villain to stir voters up. They have to point a finger somewhere to make sense out of a complicated topic. More importantly, they cannot upset the donors or corporations that give them money, at least not too much. Too often politicians use the subject of taxes to further their political ambitions without speaking honestly about the facts. What facts?

The most important fact is that politicians will not take away tax breaks that make the effective tax rate lower than the published tax rate because the corporations and wealthy folks do not want them to. All this rhetoric about watching out for the middle class is just that, rhetoric. Eliminating tax breaks and loopholes would instantly make the tax laws fair. No matter what they say.

It is possible, and easy, to create a simple and fair tax system. The simplest way to do this is by eliminating every single tax break and loophole and creating a tiered flat tax. We already have a flat tax that you probably pay every day, and you probably never think of it as being unfair.

Consider this, do you get upset when you pay the flat sales tax at a store even if others making more or less money than you pay that same flat sales tax? What about the person who must purchase more groceries due to the size of their family, should they get a tax break? You probably do not think about it because that is just the way it is, that is how the politicians have structured sales tax. But what if all the family's with children gathered together and told their political leaders they wanted a sales tax reduction for families that purchase more groceries than single people? What if that group of families represented more than half the votes and threatened to use those votes? You would get at least one candidate that would fight for that particular tax break. Get the picture?

So what is a fair and straightforward tax system? Easy, we just did those calculations. In our example, we collected 10.3% in Individual and Corporate Income tax to equal the amount received in 2015. If we want to eliminate the $620B deficit, we would need to collect an additional 3.5% tax taking the total to 13.8%. Simple. Why don't we just do that? Because change is always hard, at least at first, and many individuals and corporations do not want to lose their loopholes and tax breaks. They will punish their politicians (and the press), they will make a big stink.

The only legitimate question is how to make the tax fair for lower-income individuals and families? Easy, you exempt people living below the poverty level from paying tax. The federal poverty level currently ranges from $12,060 for an individual to $51,670 for a family of eight, depending on which state you live in and the number of dependents you declare. You write the law so that taxpayers with income below the poverty level pay no tax, and to make up that lost tax you increase the tax rate slightly. So, here is the David Resnick 2017 Tax Reform Act.

2017 Revised Tax Code

Tax Brackets for Individual and Corporate Income Tax -

0% for taxpayers with income below the federal poverty level.

15% for taxpayers with income at or below $150,000.

20% for taxpayers with income above $150,000.

20% for corporations.

Losses for individuals and corporations may be carried forward indefinitely.

Total Individual Income Tax gets reduced so that the combined Income and Payroll tax does not exceed 20% for any taxpayer.

There it is folks. On a napkin, fair, and easy to understand. No loopholes or tax breaks. No passive or long-term income. No complicated forms or calculations. Nobody pays more than one-fifth of their hard earned money in federal tax. Most importantly, this would generate more tax than is currently collected.

You probably don't believe it could be that simple, but it is. The only reason this common sense approach does not happen is that there are groups of people that think tax breaks are essential for one reason or another and they are willing to fight for them. That means they are willing to work hard to keep them. They are ready to withhold or obtain votes for politicians. They are willing to promote or discredit stories reported by the press. What are "We The People" going to do about it?